The Only Guide to Property Damage

5 Easy Facts About Loss Adjuster Shown

Table of ContentsProperty Damage Things To Know Before You BuyPublic Adjuster - QuestionsGetting My Public Adjuster To Work

A public insurer is an independent insurance specialist that an insurance policy holder might hire to assist clear up an insurance policy claim on his/her behalf. Your insurance provider provides an adjuster at on the house to you, while a public insurance adjuster has no relationship with your insurance provider, and also bills a charge of approximately 15 percent of the insurance policy settlement for his or her solutions.

If you're believing of working with a public insurer: of any type of public adjuster. Ask for referrals from household and also partners - public adjuster. Make sure the insurance adjuster is licensed in the state where your loss has actually occurred, and also call the Bbb and/or your state insurance policy division to inspect up on his/her record.

Your state's insurance department may set the percentage that public adjusters are allowed fee. Watch out for public insurers that go from door-to-door after a catastrophe. property damage.

Financial savings Compare prices and also save on residence insurance today! When you file an insurance claim, your house owners insurance company will designate a cases adjuster to you.

How Property Damage can Save You Time, Stress, and Money.

Like a claims insurer, a public adjuster will assess the damages to your residential property, assistance determine the scope of repair services as well as approximate the replacement value for those fixings. The big distinction is that rather of working with behalf of the insurance company like an insurance declares insurer does, a public claims adjuster benefits you.

The NAPIA Directory site lists every public adjusting company needed to be certified in their state of operation (loss adjuster). You can enter your city and also state or postal code to see a listing of adjusters in your location. The other means to discover a public insurance insurer is to get a recommendation from good friends or family members.

The majority of public adjusters keep a portion of the last insurance claim payment. If you are encountering a sites large case with a possibly high payout, aspect in the rate prior to choosing to hire a public insurance adjuster.

Rumored Buzz on Property Damage

:max_bytes(150000):strip_icc()/Claims-Adjuster-Final-13a775b75bc24f76a498c62257616e4e.jpg)

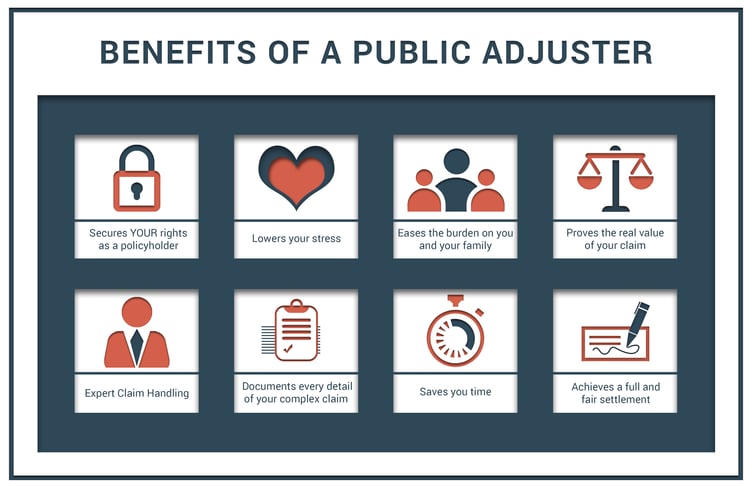

To attest to this dedication, public adjusters are not paid up front. Instead, they obtain a percent of the negotiation that they get on your behalf, as controlled by your state's department of insurance policy. A knowledgeable public adjuster functions to complete a number of jobs: Understand as well as assess your insurance coverage Support your legal rights throughout your insurance coverage claim Properly and thoroughly analyze and also value the extent of the residential property damage Apply all policy arrangements Discuss a made find this the most of settlement in an effective and also effective fashion Working with a skilled public adjuster is one of the very best means to get a quick and fair negotiation on your claim.

Your insurance coverage company's reps are not always going to look to reveal all of your losses, seeing as it isn't their obligation or in their finest rate of interest. Considered that your insurance provider has a professional working to safeguard its rate of interests, shouldn't you do the very same? A public insurance adjuster can work with various sorts of cases on your part: We're often asked concerning when it makes feeling to employ a public insurance claims insurer.

The bigger and more complicated the case, the a lot more likely it is that you'll need expert aid. Employing a public adjuster can be the right choice for several kinds of home insurance coverage claims, particularly when the stakes are high. Public insurers can aid with a number of important jobs when navigating your insurance claim: Interpreting policy language and establishing what is covered by your service provider Performing an extensive evaluation of your insurance plan Taking into consideration any type of current changes in structure codes as well as laws that may supersede the language of your policy Finishing a forensic assessment of the residential property damage, often revealing damage that can be otherwise hard to locate Crafting a customized prepare for getting the very best negotiation from your residential or commercial property insurance claim Documenting as well as valuing the full level of your loss Putting together photographic evidence to sustain your insurance claim Taking care of the day-to-day jobs that often come with suing, such as interacting with the insurance company, going to onsite conferences and sending files Providing your insurance claims bundle, consisting of sustaining paperwork, to the insurer Masterfully bargaining with your insurance provider to guarantee the largest settlement feasible The best component is, a public claims adjuster site can obtain involved at any factor in the insurance claim filing procedure, from the minute a loss strikes after an insurance claim has currently been paid or rejected.